Filing your income tax return can be complex, especially when considering the various schedules that may apply to your financial situation. To help you navigate through the process with confidence, let’s explore all the schedules you need to know when filling out IRS Form 1040.

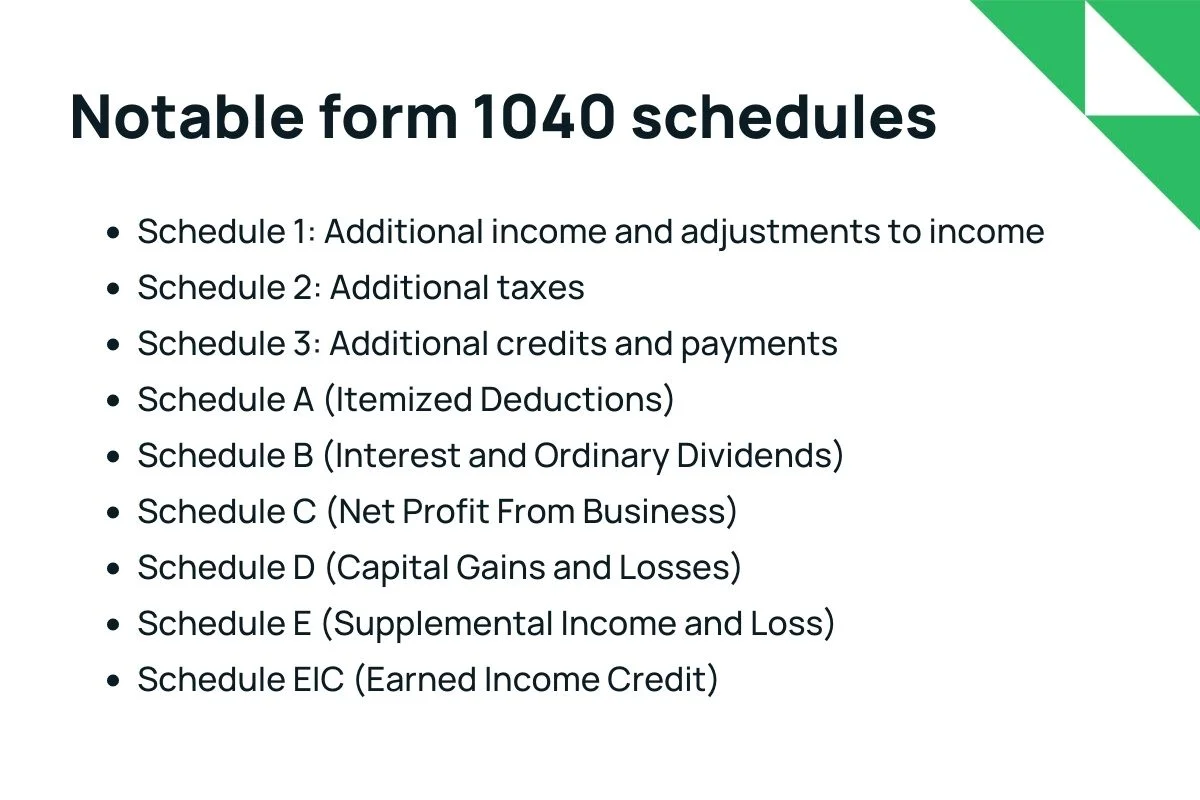

All Form 1040 schedules you need to know

Schedule 1: Additional income and adjustments to income

1040 Schedule 1 is used to report additional sources of income and make adjustments to your total income that are not covered on the main Form 1040. Here are some items that may require you to use Schedule 1:

- Alimony income or payments.

- Business income and expenses for self-employed individuals or sole proprietors.

- Rental income and expenses for landlords.

- Farm income and expenses for farmers.

- Unemployment compensation received during the tax year.

- Educator expenses for teachers.

- Deductible moving expenses.

- Deductible contributions to a Health Savings Account (HSA).

- Deductible expenses for self-employed individuals, such as health insurance premiums.

- Student loan interest deduction.

For the complete list of items, check this form of Schedule 1 in tax year 2022 from the IRS.

Schedule 2: Additional taxes

Schedule 2 comes into play if you have specific tax situations that require additional reporting. Some situations that may require you to use Schedule 2 include:

- Alternative minimum tax (AMT).

- Excess advance premium tax credit repayment.

- Additional taxes on IRAs or other retirement plans.

- Self-employment tax for self-employed individuals.

- Additional Medicare tax on high earners.

- Net investment income tax for taxpayers with significant investment income.

For the complete list of items, check this form of Schedule 2 in tax year 2022 from the IRS.

Schedule 3: Additional credits and payments

1040 Schedule 3 is used to claim additional tax credits or report other payments that may affect your tax liability. Some items covered in Schedule 3 include:

- Foreign tax credit for taxes paid to a foreign country on foreign income.

- Education credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

- Child and dependent care expenses credit.

- Retirement savings contributions credit.

- Residential energy-efficient property credit.

- General business credit for certain business-related expenses.

- Excess Social Security tax withheld.

For the complete list of items, check this form of Schedule 3 in tax year 2022 from the IRS.

See More: How to Quickly Fill Out Form 1040 Schedule 3

Schedule A (Itemized Deductions)

Form Schedule A is for taxpayers who choose to itemize their deductions instead of taking the standard deduction. Some common itemized deductions reported on Schedule A include:

- Medical and dental expenses exceeding a certain percentage of your adjusted gross income (AGI).

- State and local income taxes or sales taxes paid.

- Real estate taxes paid on your primary residence and other properties.

- Home mortgage interest on loans up to a certain limit.

- Charitable contributions made to qualifying organizations.

- Casualty and theft losses.

Read More: 4 Tips To Claim Max Donation Deductions for Taxes

For the complete list of items, check this form of Schedule A in tax year 2022 from the IRS.

Schedule B (Interest and Ordinary Dividends)

Form 1040 schedule b Schedule B is used to report interest and ordinary dividends received during the tax year. You may need to use this schedule if you received interest or dividend income from:

- Bank accounts and certificates of deposit.

- Bonds and other interest-bearing investments.

- Dividend-paying stocks or mutual funds.

For filing requirements, check this article about Schedule B in tax year 2022 from the IRS.

Schedule C (Net Profit From Business)

1040 Schedule C is essential for self-employed individuals, sole proprietors, and single-member LLCs (SMLLCs) to report their business income and expenses. Some key points related to Schedule C include:

- Reporting gross income from business activities.

- Deducting eligible business expenses.

- Calculating the net profit or loss from the business.

- Carrying the net profit or loss to the main Form 1040.

Schedule D (Capital Gains and Losses)

IRS Schedule D is used to report capital gains and losses from the sale of assets, such as stocks, bonds, real estate, cryptocurrency, and other investments. It helps determine the tax implications of your investment transactions and includes:

- Reporting short-term capital gains and losses (assets held for one year or less).

- Reporting long-term capital gains and losses (assets held for more than one year).

- Calculating the net capital gain or loss.

- Carrying the net capital gain or loss to the main Form 1040.

- Carrying unallowed capital loss from the previous year.

Schedule E (Supplemental Income and Loss)

1040 Schedule E is used to report supplemental income and loss from various sources, including:

- Rental income from real estate properties.

- Royalties from intellectual property, such as copyrights or patents.

- Income from partnerships, S corporations, trusts, and estates.

- Certain real estate activities, like real estate professionals reporting rental activities.

Schedule EIC (Earned Income Credit)

Schedule EIC is specifically for taxpayers who qualify for the Earned Income Credit (EIC). This credit is designed to benefit low to moderate-income individuals and families. The schedule helps determine the eligibility and amount of the EIC based on your earned income and family size.

Other Form 1040 Schedules

In addition to the schedules mentioned above, there are other schedules that cater to specific tax situations. Depending on your circumstances, you might need to include one or more of those with your Form 1040. Some examples include schedule F (Profit or Loss From Farming) for farmers reporting farming activities, schedule H (Household Employment Taxes) for individuals employing household workers, and schedule SE (Self-Employment Tax) to calculate self-employment taxes.

Note: If you have to file Schedule C, you might also need to file Schedule SE

Different Types of 1040 Forms

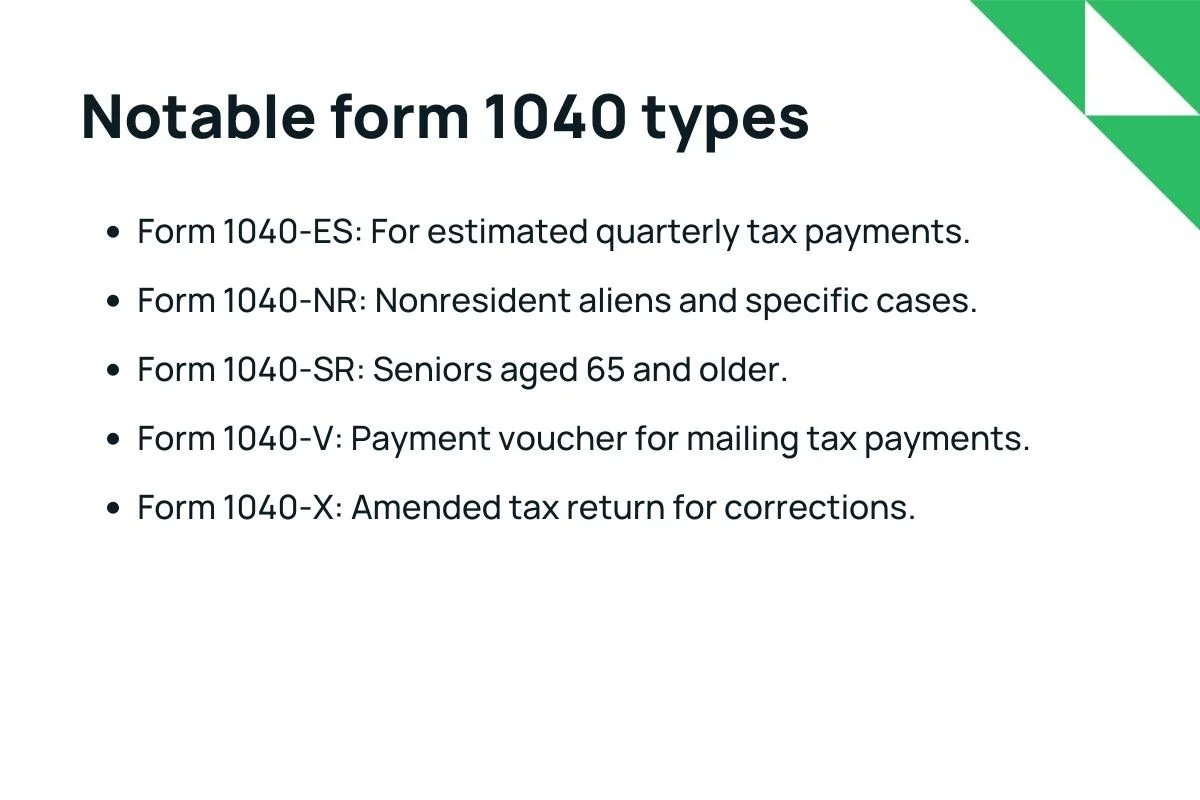

IRS Form 1040 comes in different variations, each tailored to meet the needs of different taxpayers. Let’s explore the types:

Form 1040-ES

Form 1040-ES – a payment voucher – is essential for freelancers, self-employed individuals, and others who need to calculate their estimated quarterly taxes. These payments are calculated based on your previous year’s income or pro-rated income of the current year. It’s crucial to make the payments on time since you might face a penalty for underpayment of estimated tax

This form is also used to estimate taxes on income that is not subject to withholding, such as dividends or interest. If you opted not to have taxes withheld from unemployment or Social Security benefits, you’ll also need to complete this form.

Form 1040-NR

Form 1040-NR is meant for nonresident aliens who engaged in business or trade within the U.S., representatives of a trust and/or estate that is required to file a 1040-NR or a representative of a deceased person who would have been obligated to file a 1040-NR.

>>>Read more: Form 1040NR Instructions: Authority On Your Side

Form 1040-SR

Form 1040-SR is a newer version of Form 1040 specifically designed for individuals aged 65 and older. The differences between Form 1040-SR and the regular 1040 tax form are mostly cosmetic. Form 1040-SR features a different color scheme, a larger font, and an embedded standard deduction table, which helps seniors claim their larger standard deduction more easily. Eligible taxpayer can always choose which forms (1040 or 1040-SR) to file.

Form 1040-V

If you owe the IRS money on your tax return and choose to pay the balance by mail instead of electronically, you’ll need to include Form 1040-V, also known as a “Payment Voucher.” This form allows you to send your payment along with your return. However, many people opt to pay their tax bills online for added convenience.

>>>Read more: Form 1040-V: Everything You Need To Know

Form 1040-X

Form 1040-X is attached in an amended tax return to show adjustments made compared to the original tax return. You’ll need to complete this form if you made a mistake on your original return, such as forgetting to include additional income. It provides a way to correct errors and update information on your previously filed return.

>>>Read more: Form 1040X Instructions: Filling Out Line by Line

Now that you’re familiar with all the important schedules and types of IRS Form 1040, we bet that you’re well-prepared to tackle your tax return. Remember that each schedule serves a specific purpose, so choose the ones that match your financial situation. If you ever need help, don’t hesitate to reach out to a tax professional. Happy filing!

Sources: utsa.edu, chegg.com, pdffiller.com