Key Takeaway

- The Child Tax Credit is worth up to $2,000 in tax year 2022. The Other Dependents Credit is valued at up to $500.

- A dependant is defined by the IRS as a qualifying child(under the age of 19 or under the age of 24 if a full-time student, or any age if permanently and totally incapacitated) or a qualifying relative.

- A qualifying dependent can earn money but cannot sustain themselves for half of the living expenses for the year.

- A taxpayer cannot claim a dependent if they themselves are a dependent, or if the dependent files a joint tax return with a spouse (unless in certain circumstances), or if the dependent is claimed as a dependent on someone else’s tax return.

What is a dependent?

A dependent is someone “other than the taxpayer or spouse” who qualifies to be claimed on another person’s tax return. A dependent is someone who relies on someone else for financial support, such as shelter, food, clothing, essentials, and so on. This usually refers to your children or other relatives, but it can also refer to someone who isn’t connected to you, such as a domestic partner.

When you list someone as a dependent on your tax return, you are alerting the IRS that you meet the criteria to claim them as a dependent.

Prior to 2018, taxpayers could deduct a specific amount from their taxable income for each dependent claimed on a tax return. This is referred to as an exemption deduction. It was $4,050 per eligible dependant in tax year 2017. Beginning in 2018, the exemption deduction was phased out and replaced by a typically more generous Child Tax Credit or the Other Child Credit, based mostly on the child’s age and relationship to the individual claiming the dependant. A credit differs from a deduction in that a credit can directly lower your tax liability, whereas a deduction can reduce the amount of income that is taxed.

What qualifies someone as a dependent?

The IRS standards for qualified dependents include almost every scenario imaginable, from housekeepers to liberated children.

There are two types of dependents, each subject to different rules:

- A qualifying child

- A qualifying relative

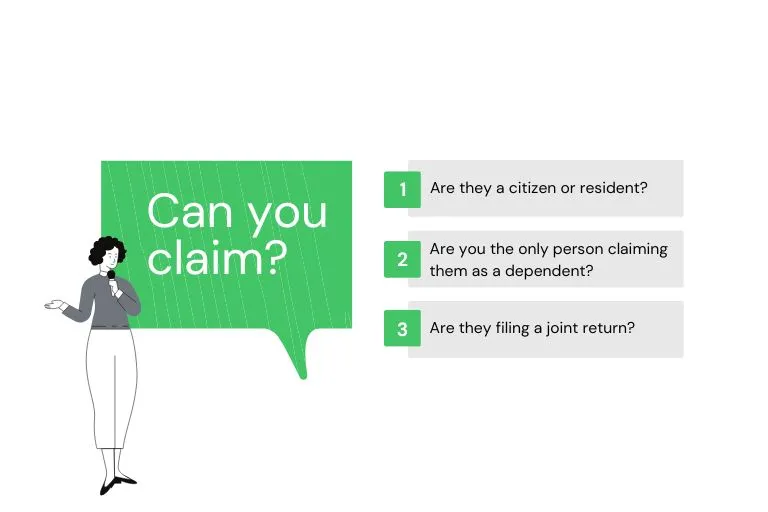

For both types of dependents, you’ll need to answer the following questions to determine if you can claim them.

- Are they a citizen or resident? The individual must be a US citizen, a US national, a US resident, or a Canadian or Mexican resident. Many individuals ask if they can claim a foreign exchange student who resides with them briefly. The answer is yes, but only if they fit the above criteria.

- Are you the only person claiming them as a dependent? You cannot claim someone who is claimed as a dependent on another tax return, who declares that they are not eligible to be claimed as a dependent on their tax return (takes a personal exemption), or who claims another person as a dependent on their tax form. This is a regular obligation for children of divorced parents. Certain “tiebreaker rules” can be found in IRS Publication 501. These guidelines outline the standards for claiming a child in terms of income, parenthood, and residency.

- Are they filing a joint return? Someone who is married and submits a joint tax return cannot be claimed. You can’t claim your married adolescent son as a dependent if he files a joint return with his spouse. This regulation does not apply if the dependent files a joint return solely to obtain a refund of withheld income tax or any anticipated tax paid.

Qualifying child

In addition to the conditions listed above, you must be able to respond “yes” to all of the following questions in order to claim an eligible kid.

- Are they related to you? The child could be your son, daughter, stepchild, suitable foster child, brother, sister, half-brother, half-sister, stepbrother, stepsister, adopted child, or any of their offspring.

- Do they meet the age requirement? Your child must be under the age of 19 or, if enrolled full-time, under the age of 24. If your child is permanently and utterly incapacitated, there is no age limit.

- Do they live with you? Your child must live with you for more than half the year, but several exceptions apply.

- Do you financially support them? Your child may have a job, but they cannot provide more than half of their own support.

Qualifying relative

Many people assist their elderly parents. But just because you occasionally send your 78-year-old mother a check doesn’t mean you can claim her as a dependent. Here’s a checklist to see if your mother (or another relative) qualifies.

- Do they live with you? Your relative must be a year-round resident of your home or be on the list of “relatives who do not live with you” in Publication 501. This list includes around 30 different sorts of relatives.

- Do they make less than $4,400 in 2022? Your relative can’t have a gross income of more than $4,400 in 2022 and be claimed by you as a dependent.

- Do you financially support them? You must provide more than half of your relative’s total support each year.

In all situations, you cannot be claimed as a dependent on someone else’s tax return if you claim someone as a dependent on your own.

Dependent rules also apply to other benefits such as:

- the Earned Income Tax Credit

- the Child and Dependent Care Credit for daycare costs, medical expenses, and several other itemized deductions, as well as the majority of tax credits involving children or family concerns

Qualifying for these benefits can make the difference between owing money and receiving a refund.

The fundamental concepts are simple, but applying them to specific family situations can be tricky. This is especially true if you have a son away at college, a relative who visits over the summer, or a daughter who works part-time. The following questions will assist you in determining which relatives you can claim as dependents.

Deductions and credits available when claiming dependents

- Earned income tax credit: The earned income tax credit is the most important financial assistance program for low to moderate-income working people. The refundable tax credit reduces income tax and typically increases tax refunds for low to moderate-income taxpayers, and it can be worth up to $6,935 for a family of three or more children in the 2022 tax year. You don’t have to have children to obtain the credit, although the credit amount is often bigger for taxpayers who have qualifying children.

- Child and dependent care credit: This refundable tax credit assists parents in paying for eligible dependent daycare while working, attending school, or if a parent is unable to care for themselves. In 2022, the maximum credit is 35% of your employment-related expenses. Once your adjusted gross income is over $43,000, the maximum credit is 20% of your employment-related expenses.

- Child Tax Credit and additional Child Tax Credit: For 2022, the child tax credit is up to $2,000 per qualifying child under age 17. Read our complete guide on Child Tax Credit!

- Credit for other dependents: If you have a qualifying relative as a dependent on your return, you’re entitled to claim a nonrefundable credit of up to $500. You can claim this for each qualifying relative you have on your tax return.

- Adoption credit: The 2022 adoption tax credit is a nonrefundable tax credit of up to $14,890 for expenses incurred in the adoption of a child who is not your stepchild. While the credit is not refundable, you may carry over any unused credit balance for up to five years. The amount of adoption credit you can claim is determined on the amount you spend on your adoption. For example, if your eligible adoption expenses are $7,000 in 2022, you cannot claim the whole $14,890 credit. Similarly, if you spent $20,000 on adoption, you can claim up to $14,890 and the remaining $5,110 may be carried forward next year and up to five years.

- Medical expenses: If you paid for medical expenditures for a qualifying child or related dependent, you may deduct them, subject to the regulations governing the medical expenses deduction. In general, this means you can deduct eligible unreimbursed medical care expenses that exceed 7.5% of your AGI. In order to take this deduction, you must itemize your deductions on Schedule A, which eliminates the opportunity to claim the standard deduction.

- American Opportunity Tax Credit and Lifetime Learning Credit: These two tax credits are intended to pay a portion of the cost of eligible education costs. This can be for yourself, your spouse, or your dependents while attending college, vocational school, or work-related training.

Frequently asked questions about claiming dependents

How much can a dependent child earn in 2022?

A qualified child can earn an infinite amount of money and yet be claimed as a dependent, as long as the child does not provide more than half of his or her own support.

If the dependent child is being claimed under the qualifying relative criteria, the child’s gross income for the year must be less than $4,400.

When does your child have to file a tax return?

In 2022, a qualified child can normally earn up to $12,950 without paying income tax. Self-employment income and unearned income, such as investment income, have differing filing thresholds for children.

When should I stop claiming my child as a dependent?

You may eventually be unable to claim your child as a dependent. It could be due to their age (if they are over the age of 18 or 23 if a full-time student), you no longer pay for half of their financial support, or they have moved out of the house. If you can’t claim them under the qualifying child dependent requirements anymore, you might be eligible to under the qualifying relative tests.

Can you claim adults as dependents on your taxes?

Adults who meet the criteria for eligible relatives can be claimed as dependents on your taxes. Many people provide care for aging parents and claim them as qualifying relative dependents. Similarly, if your domestic partner meets the standards, you can claim them as a dependent on your tax return.

The income test is typically the most difficult hurdle to surmount when claiming an adult as a dependent. Adult dependents cannot earn more than $4,400 per year in 2022. If you fulfill all of the rules and the adult meets the criteria, you can claim them as an adult dependent, allowing you to claim additional tax deductions and credits to reduce your tax payment.

>>People also read: