EV tax credits and incentives is one of the driving factors behind the increasing popularity of electric cars (EVs). These financial benefits will not only encourage consumers to adopt sustainable transportation, but also help to reduce the initial cost barrier surrounding EV purchases. We’ll go over the many components of EV tax credits and incentives for 2023-2024 in this complete guide, so you can make an informed decision about your next purchase.

Federal EV Tax Credits: Encouraging Sustainable Transportation

The federal EV tax credits, a financial incentive designed to encourage the adoption of electric vehicles, is at the heart of EV incentives. Individuals and corporations purchasing qualified new EVs can earn a tax credit up to $7,500 under this initiative in 2023 or after. It should be noted, this credit is nonrefundable and cannot exceed the amount of taxes payable, also, you can’t apply any excess credit to future tax years.

Qualification Criteria and Income Limits

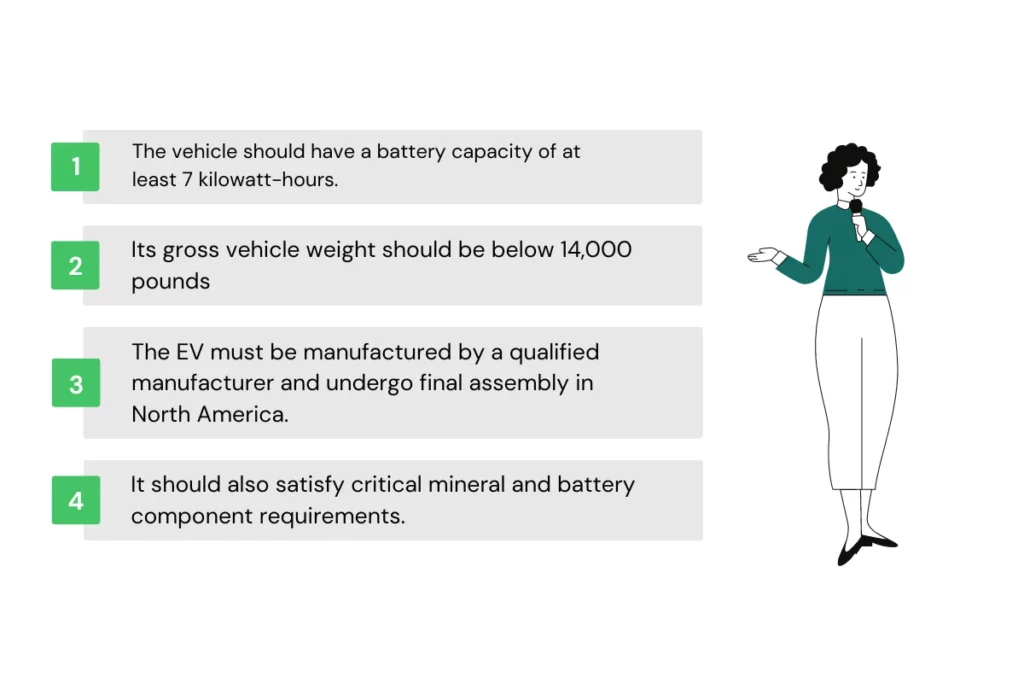

To qualify for the federal EV tax credits, the EV must meet certain criteria:

Income limits play a role in determining eligibility for the federal tax credits. For married couples filing jointly, the modified adjusted gross income (AGI) should not exceed $300,000; for heads of households, the limit is $225,000; and for other filers, it’s $150,000.

Support from State and Local Incentives

In addition to federal incentives, several states and utility companies offer their own incentives to promote EV adoption. These incentives can range from tax credits to rebates and discounts on home charger installations. For example, Colorado offers EV tax credits ranging from $5,000 to $8,000 on EV purchases, while California’s Clean Vehicle Rebate Project provides rebates from $1,000 to $7,500 for eligible zero-emission vehicles.

Leasing an EV: A Pathway to Incentives

Under the Inflation Reduction Act, leased EVs are classified as “commercial vehicles.” This classification makes them eligible for the full federal clean vehicle credit, bypassing some stringent criteria for direct purchase incentives. Notably, specific manufacturing rules don’t apply to commercial vehicles.

In essence, the tax credit advantage lies with lessors, who can employ the credit to reduce lease costs. This distinctive strategy offers potential lessees an indirect way to reap the rewards of tax incentives, making EV leasing an attractive choice that combines benefits and affordability.

People also read: Adoption Tax Credit: A Comprehensive Tax Guide 2023

2023-2024: EV Models and Tax Credits

Understanding which models qualify for EV tax credits is crucial when planning your purchase. Below is a selection of 2023-2024 EV models and their corresponding tax credit amounts based on their type, MSRP limit, and assembly location:

| Model | Year | Vehicle Type | Credit Amount | MSRP Limit | Assembled in USA |

|

BMW |

|||||

| X5 xDrive50e | 2024 | PHEV | $3,750 | $80,000 | Yes |

|

Cadillac |

|||||

| LYRIQ | 2023-2024 | EV | $7,500 | $80,000 | Yes |

|

Chevrolet |

|||||

| Blazer | 2024 | EV | $7,500 | $80,000 | Yes |

| Bolt | 2022-2023 | EV | $7,500 | $55,000 | Yes |

| Bolt EUV | 2022-2023 | EV | $7,500 | $55,000 | Yes |

| Equinox | 2024 | EV | $7,500 | $80,000 | Yes |

| Silverado | 2024 | EV | $7,500 | $80,000 | Yes |

|

Ford |

|||||

| E-Transit | 2022-2023 | EV | $3,750 | $80,000 | Yes |

| Escape Plug-in Hybrid | 2022-2023 | PHEV | $3,750 | $80,000 | Yes |

| F-150 Lightning (Extended Range Battery) | 2022-2023 | EV | $7,500 | $80,000 | Yes |

| F-150 Lightning (Standard Range Battery) | 2022-2023 | EV | $7,500 | $80,000 | Yes |

| Mustang Mach-E (Extended Range Battery) | 2022-2023 | EV | $3,750 | $80,000 | Yes |

| Mustang Mach-E (Standard Range Battery) | 2022-2023 | EV | $3,750 | $80,000 | Yes |

|

Jeep |

|||||

| Grand Cherokee PHEV 4xe | 2022-2023 | PHEV | $3,750 | $80,000 | Yes |

| Wrangler PHEV 4xe | 2022-2023 | PHEV | $3,750 | $80,000 | Yes |

|

Tesla |

|||||

| Model 3 Long Range All-Wheel Drive | 2023 | EV | $7,500 | $55,000 | Yes |

| Model 3 Performance | 2022-2023 | EV | $7,500 | $55,000 | Yes |

| Model 3 Standard Range Rear-Wheel Drive | 2022-2023 | EV | $7,500 | $55,000 | Yes |

| Model Y All-Wheel Drive | 2022-2023 | EV | $7,500 | $80,000 | Yes |

| Model Y Long Range All-Wheel Drive | 2022-2023 | EV | $7,500 | $80,000 | Yes |

| Model Y Performance | 2022-2023 | EV | $7,500 | $80,000 | Yes |

|

Volkswagen |

|||||

| ID.4 AWD PRO | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 AWD PRO S | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 AWD PRO S PLUS | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 PRO | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 PRO S | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 PRO S PLUS | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 S | 2023 | EV | $7,500 | $80,000 | Yes |

| ID.4 STANDARD | 2023 | EV | $7,500 | $80,000 | Yes |

Don’t see your EV on the list? You can check here for more information.

How Much Can I Receive From EV Tax Credit in 2023?

If you’re in the market for an EV, you’ll be pleased to know that the Inflation Reduction Act has made some changes to the EV tax credit.

One of the most significant changes is that the maximum credit for new EVs has been increased to $7,500.

Additionally, the credit for used EVs has been expanded to the lesser of $4,000, limited to 30% of the sale price.

These changes mean that you can save a substantial amount of money on your fuel cell vehicle purchase.

How Can You Claim the EV Tax Credit for A Car Purchased in 2022?

If you bought an EV in 2022, you might wonder how to get clean vehicle credit. Luckily, the Inflation Reduction Act has some good news for you.

If you had a written, binding sales contract from 2022 to purchase an EV that will be placed in service (which means “delivered” for IRS purposes) on or after the IRA became effective, you can still claim the old EV tax credit.

That means if your EV is otherwise eligible for the old tax credit, you can claim it under the rules that applied before the Inflation Reduction Act became law.

And here’s a bonus – the North American final assembly requirement only applies after the IRA effective date.

So if you’re the proud owner of a new electric vehicle, remember to check if you’re eligible for the tax credit. It could save you a significant amount of money.

See More: Form 8821 Instructions: The Ultimate Guide

How To Claim the EV Tax Credit in 2023?

To claim the clean vehicle tax credit on a new or used electric car purchased in 2022, you must file Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, with your 2022 tax return.

Required Documents from Seller

When buying an electric vehicle, there are certain documents you’ll need to claim the EV tax credit on your taxes. Don’t worry – the dealership should provide you with these documents, but it’s always good to double-check before you leave. Here are the documents you will need:

A report from the seller containing specific information about the vehicle. This report should be furnished to you by the date of the vehicle’s purchase and should include the following:

- The seller’s name and taxpayer identification number (TIN).

- Your name and TIN.

- Your Gross Vehicle Weight

- The date of sale and sales price.

- Verification of the maximum tax credit available for the car.

- The clean vehicle’s VIN is on the vehicle’s window sticker or identification number.

- The clean vehicle’s battery capacity.

- Verification that you are the original user of the car.

- A declaration signed by the seller under penalty of perjury.

With these documents, you can claim the EV tax credits on your taxes and save money on your purchase.

Navigating the Landscape of EV Tax Credits Incentives

These EV tax credits don’t just chip away at the initial cost of the vehicles; they’re paving the road to a greener future, reducing our reliance on fossil fuels. Navigating this landscape requires a deep dive into federal and state incentives. Before you set a course on your electric adventure, arming yourself with knowledge is the key. Our expert here at Xoa Tax can help you achieve it.

>>>You may be also interested in:

[UPDATES] Section 179 Deduction Vehicle List 2023

Tax Topic 152: Your Key to Tax Refunds

Loan to Shareholder on Balance Sheet: How It Works