A balance sheet is a really important paper for any business. It’s like a photo that shows what a company has (like balance of money and goods), what it owes (like loans), and how much the business is worth to its owners at a certain time. In this article, we’re going to talk about what a balance sheet is, how it works, and why it’s so important for businesses. Understanding a balance sheet can help anyone in business make better decisions and know how well the company is doing. Let’s take a closer look at this important financial statement.

Key takeaways:

- A balance sheet is a financial statement that shows a company’s assets (what it owns), liabilities (what it owes), and shareholders’ equity (the owners’ investment) at a specific date.

- The balance sheet is crucial for understanding a company’s financial health, including its ability to make profits and maintain stability.

- Externally, they are used by banks, investors, and other institutions to evaluate a company’s financial status and risk.

- To fully understand financial trends and changes, it’s important to compare balance sheets from the different time period, along side with income statement and cashflow statement.

What Is a Balance Sheet?

A balance sheet is a key financial document for any company, showing what the company owns (assets), what it owes (liabilities), and the value for its shareholders (shareholders’ equity) at a specific point in time. It’s like a financial snapshot, capturing the company’s situation on a particular day. This document is crucial as it provides insights into the company’s financial performance and structure, helping to determine its profitability and stability.

How a Balance Sheet Works

The balance sheet gives a snapshot of a company’s financial status at a specific time. However, it doesn’t show trends over time by itself. Therefore, it’s important to compare it with balance sheets from previous periods.

Several financial ratios derived from the balance sheet, such as the debt-to-equity ratio and the acid-test ratio, provide insights into a company’s financial health. The income statement and cash flow statement also offer important context for evaluating a company’s finances, along with any notes or supplementary information in an earnings report that might reference the balance sheet.

The balance sheet is based on a simple accounting equation:

Assets = Liabilities + Equity

This equation is logical because a company finances everything it owns (assets) by either borrowing money (incurring liabilities) or getting it from investors (through shareholder equity).

For example, if a company borrows $4,000 from a bank for five years, its assets and liabilities will both increase by $4,000, maintaining balance. Similarly, if it receives $8,000 from investors, both its assets and shareholder equity will rise by that amount. Any revenue exceeding expenses will boost the shareholder equity account, and this increase will be mirrored in the assets side, showing up as cash, investments, inventory, or other assets.

>>You may also like:

Components of a Balance Sheet

Current Assets

These include cash and other assets expected to be converted into cash within a year, such as accounts receivable and inventory.

Fixed Assets

These are assets like property or equipment used in operations to generate income, intended for long-term use. Their value decreases over time due to wear and tear, a process known as depreciation, which is recorded on the income statement.

Current Liabilities

These are debts and other obligations due within a year, such as accounts payable, credit card bills, collected sales taxes, payroll liabilities, and loan payments.

Long-term Liabilities

These are debts and obligations not due within the next year, like term loans and mortgages.

Shareholders’ Equity

This consists of common and preferred stock, paid-in capital, and retained earnings, which are the accumulated company profits not distributed to shareholders.

An Example of Balance Sheet

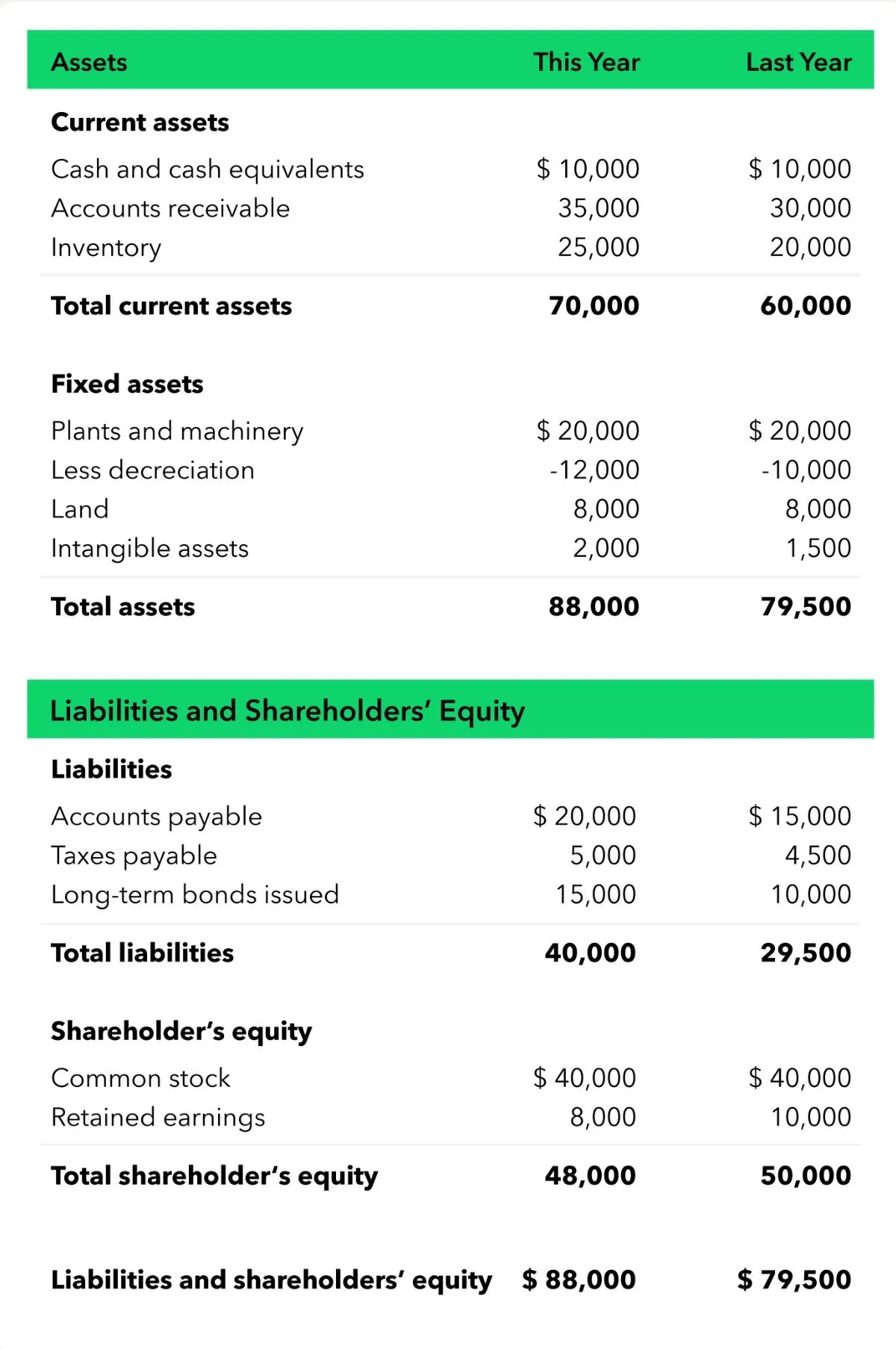

Here’s a balance sheet example:

On a typical balance sheet, assets are listed at the top, categorized into current and fixed (or long-term) assets, ordered from most to least liquid.

The same logic applies to liabilities and shareholder’s equity, with the most liquid elements listed first. Presenting two years on a balance sheet allows for tracking changes across reporting periods.

What are the Uses of a Balance Sheet?

Here’s the importance of balance sheet:

A balance sheet reveals a company’s financial standing at a specific date, unlike an income statement which covers a period. It’s often used by external parties like banks and lenders to assess a company’s financial health. They may use financial ratios derived from the balance sheet to evaluate the company’s risk level, asset liquidity, and solvency prospects.

Internally, a company might use its balance sheet to assess risk, ensure sufficient cash reserves, and decide on capital raising strategies (either through debt or equity), though it often finds more utility in the income statement for such purposes.

Download a Balance Sheet Template

For those who need to manually create a balance sheet, we offer you a free, fillable template available for download. However, it’s generally recommended to generate financial statements through accounting software or with the assistance of an accountant.

Whether you’re a startup taking your first steps, a growing business ready to expand, or an established company looking for smarter financial strategies, XOA TAX has the expertise and tools to guide you. Our services are not one-size-fits-all; they are as unique as your business. From comprehensive bookkeeping to insightful financial planning, we offer a range of services designed to meet your specific needs.