So you have your idea and business plans ready. It’s time to register your business to make it a distinct legal entity. How and where you need to register depends on your business structure and business location.

Find out if you need to register your business

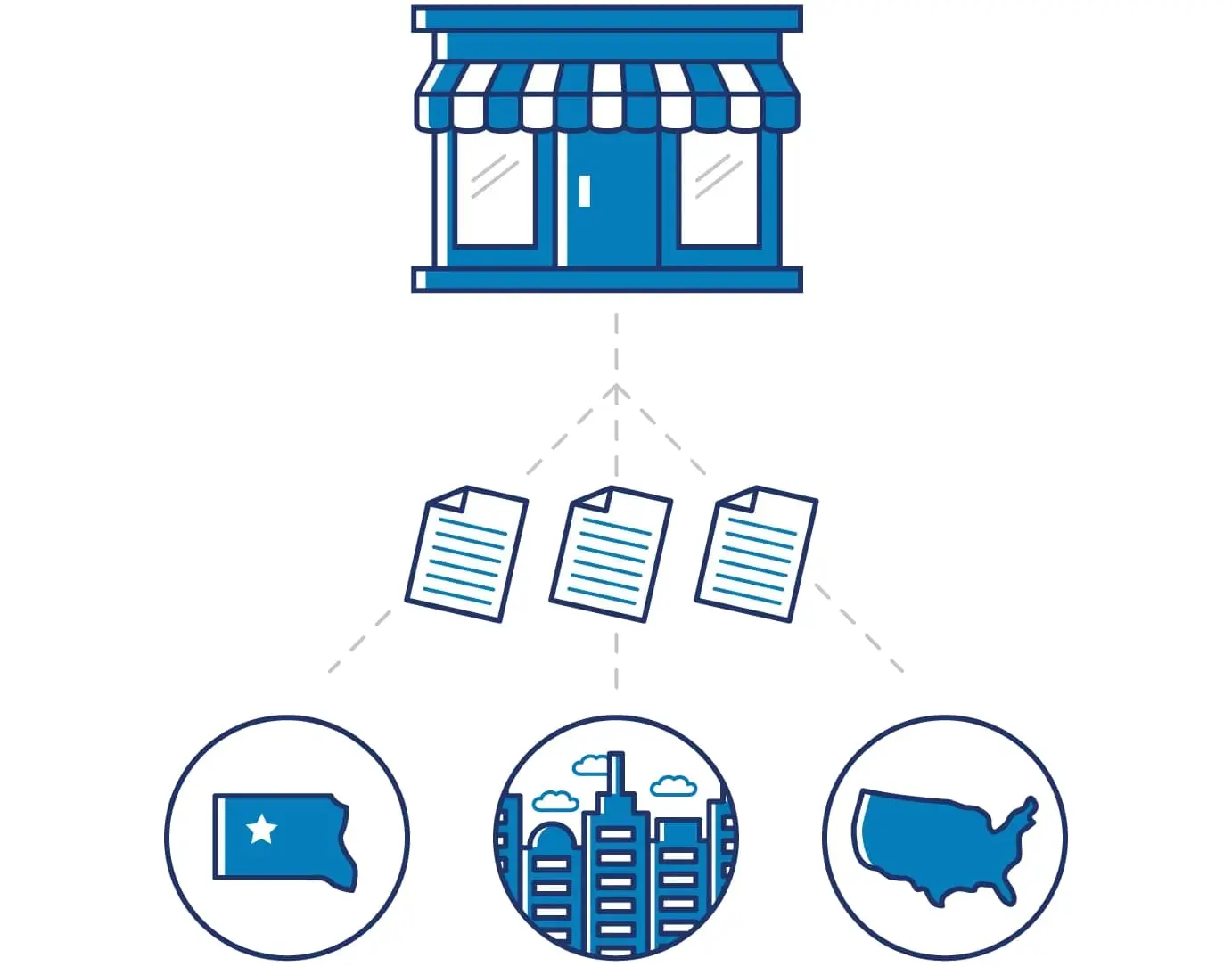

Your location and business structure determine how you’ll need to register your business. Determine those factors first, and registration becomes very straightforward.

For most small businesses, registering your business is as simple as registering your business name with state and local governments.

More: How to Determine Whether a Business Name Is Available

In some cases, you don’t need to register at all. If you conduct business as yourself using your legal name, you won’t need to register anywhere. But remember, if you don’t register your business, you could miss out on personal liability protection, legal benefits, and tax benefits.

More than a sign-up sheet

Meet John and Kelly. They own an auto repair shop and need to inform the proper authorities that they are operating a business by registering their shop.

Registration requirements vary by state, so John and Kelly first contact their state and local government for information about how to register their auto repair shop.

Because John and Kelly are using a fictitious name for their auto repair shop — rather than their own legal names — they are required to register their business name. They register the name of their business — what’s called a “Doing Business As” (DBA) name — with the appropriate office (the county clerk or state government, depending on where the business is located, although a few states don’t require DBA name registration).

After registering their DBA name — based on laws of the state, county, and town they registered in — John and Kelly publish a public notice in a local newspaper announcing their new business. They provide proof of publication to the office they registered with.

There are fees associated with the registration process (usually less than $100), but John and Kelly accounted for those costs in their original budget. They also have to pay the newspaper for the public notice.

John and Kelly’s state also requires that they provide documents to the tax board soon after registering (not all states have this requirement).

John and Kelly’s auto repair shop is officially registered with the appropriate offices.

Register with federal agencies

Most businesses don’t need to register with the federal government to become a legal entity, other than simply filing to get a federal tax ID. Small businesses sometimes register with the federal government for trademark protection or tax exempt status.

if you want to trademark your business, brand or product name, file with the United States Patent and Trademark office once you’ve formed your business.

If you want tax-exempt status for a nonprofit corporation, register your business as a tax-exempt entity with the IRS.

To create an S corp, you’ll need to file form 2553 with the IRS.

Register with state agencies

If your business is a limited liability company (LLC), corporation, partnership, or nonprofit corporation, you’ll probably need to register with any state where you conduct business activities.

Typically, you’re considered to be conducting business activities in a state when:

- Your business has a physical presence in the state

- You often have in-person meetings with clients in the state

- A significant portion of your company’s revenue comes from the state

- Any of your employees work in the state

Some states allow you to register online, and some states make you file paper documents in person or through the mail.

Most states require you to register with the Secretary of State’s office, a Business Bureau, or a Business Agency.

Get a registered agent

If your business is an LLC, corporation, partnership, or nonprofit corporation, you’ll need a registered agent in your state before you file.

A registered agent receives official papers and legal documents on behalf of your company. The registered agent must be located in the state where you register.

Many business owners prefer to use a registered agent service rather than take on this role themselves.

File for foreign qualification

If your LLC, corporation, partnership, or nonprofit corporation conducts business activities in more than one state, you might need to form your business in one state and then file for foreign qualification in other states where your business is active.

The state where you form your business will consider your business to be domestic, while every other state will view your business as foreign. Foreign qualification notifies the state that a foreign business is active there.

Foreign qualified businesses typically need to pay taxes and annual report fees in both their state of formation and states where they’re foreign qualified.

To foreign qualify, file a Certificate of Authority with the state. Many states also require a Certificate of Good Standing from your state of formation. Each state charges a filing fee, but the amount varies by state and business structure.

Check with state offices to find out foreign qualification requirements and fees.

File state documents and fees

In most cases, the total cost to register your business will be less than $300, but fees vary depending on your state and business structure.

The information you’ll need typically includes:

- Business name

- Business location

- Ownership, management structure, or directors

- Registered agent information

- Number and value of shares (if you’re a corporation)

The documents you need — and what goes in them — will vary based on your state and business structure.

| Business structure | Document | Description |

| LLC | Articles of organization | An easy-to-read document called the articles of organization outlines the fundamentals of your LLC. It contains business details such as the registered agent, member names, address, and company name. |

| LLC | LLC operating agreement | An operational agreement lays out how your business makes functional and financial choices. It outlines each member’s roles, powers, and duties as well as the process by which important company decisions are made. Even if it’s not required by law in your state, it’s generally advised to have one to safeguard both your company and yourself. |

| Limited partnership | Certificate of limited partnership | This brief agreement outlines the fundamentals of your limited partnership. It includes essential business information such as the company name, address, and partner names and notifies the state of the partnership’s existence. Some states refer to it by a different name, and not all states require it. |

| Limited partnership | Limited partnership agreement | A limited partnership agreement outlines each partner’s roles, authority, and obligations as well as how business decisions are made. It is an internally enforceable contract between all partners. Even if it’s not required by law in your state, it’s generally advised to have one to safeguard both your company and yourself. |

| Limited liability partnership | Certificate of limited liability partnership | The fundamentals of your limited liability partnership are outlined in this brief document. It includes essential business information such as the company name, address, and partner names and notifies the state of the partnership’s existence. Some states refer to it by a different name, and not all states require it. |

| Limited liability partnership | Limited liability partnership agreement | A limited liability partnership agreement outlines each partner’s roles, authority, and obligations as well as how business decisions are made. It is an internally enforceable contract between all partners. Even if it’s not required by law in your state, it’s generally advised to have one to safeguard both your company and yourself. |

| Corporation (any kind) | Articles of incorporation | A certificate of incorporation, also known as the articles of incorporation, is a thorough legal document that outlines the fundamentals of your company. Every state requires it at the time of incorporation. The company name, goal for the firm, amount of shares offered, share value, directors, and officers are the most frequently mentioned details. |

| Corporation (any kind) | Bylaws or resolutions | A corporation’s internal governance documents are its bylaws, sometimes known as resolutions for nonprofit organizations. They specify the procedures for making important company decisions as well as the roles, responsibilities, and authority of officers and shareholders. Even if it’s not required by law in your state, it’s generally advised to have one to safeguard both your company and yourself. |

Furthermore, if you use a DBA, certain jurisdictions mandate that you register it. A DBA might be a trade name or a fake identity. To find out what is necessary in your location, contact the government office of your state.

Register with local agencies

Usually, forming a business does not require registration with the county or city government.

You may be required to apply for licenses and permissions from the county or city if your company is an LLC, corporation, partnership, or nonprofit organization.

If you use a DBA, whether it be a trade name or a fictional name, certain counties and towns also need you to register it.

To find out what you need to do, visit the websites of your local government. Local governments set the requirements for permits, licenses, and registration.

Stay up to date with registration requirements

Depending on your business structure, several states require you to give reports shortly after registering.

It could be necessary for you to submit extra paperwork to the franchise tax board or state tax board. Usually known to as Initial Reports or Tax Board registration, these filings are required to be submitted within 30 and 90 days following your state registration.

If it applies to you, inquire with the franchise tax board or your local tax office.