Buying a car is an investment many of us make in our lives, often at considerable expense. You use cars so much; commuting to work, getting the kids to school or soccer practice, running errands, or going on weekend trips.

Your vehicles are with us in the happiest and busiest times of our lives – that’s why some people get creative with bobbleheads and tassels! But understandably, all these expenses begin to add up.

Fortunately, there is a way to get some of your money back: Section 179 of the IRS allows business owners to deduct the full purchase price of qualifying equipment as expenses when the properties are placed in service.

Check out Section 179 Deduction Vehicle List 2023 to save money and reduce your expenses today!

Key Takeaways

- Qualifying vehicles must be more than 50% of the vehicle’s use for business purposes.

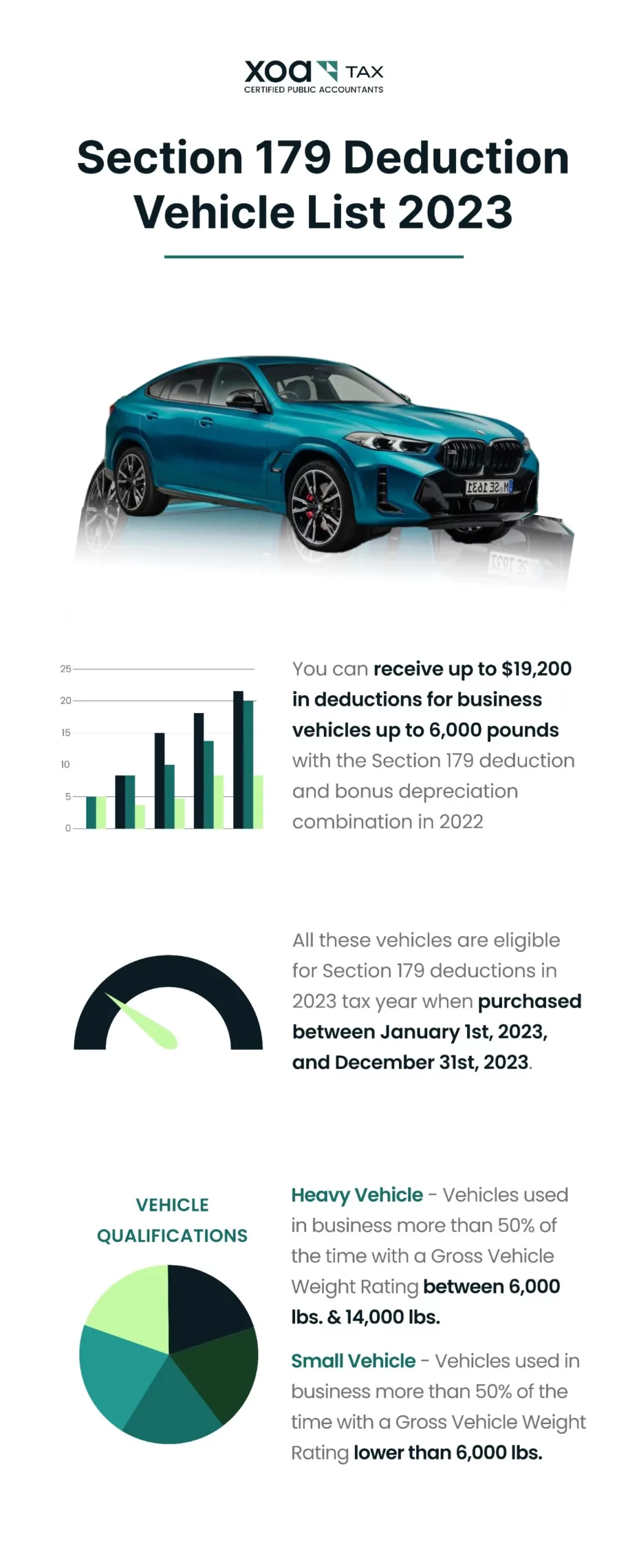

- In 2022, with the combination of Section 179 deduction and bonus depreciation, you’re eligible for deductions of up to $19,200 for business vehicles weighing up to 6,000 pounds.

- Generally, you can get up to a $27,000 first-year deduction in 2022 ($28,900 in 2023) for vehicles weighing over 6,000 but not more than 14,000 pounds. After that, you need to follow a regular depreciation schedule.

Understanding Section 179 Deduction

The IRS tax code has long allowed businesses to claim deductions for tangible personal property for business purposes. The most common examples are computers, office furniture, or other equipment used in your day-to-day operations.

For the tax return of the year 2022, the deduction limit is $1,080,000 of the full purchase price of qualifying equipment. In 2023, this limit will increase to $1,160,000 due to inflation adjustment.

However, it’s critical to note that this deduction begins to phase out once the full cost of all qualifying equipment purchased surpasses a specific limit – $2.7M for the tax year 2022.

This is an essential point of consideration for the small business owner, as understanding the amount you can claim and what vehicles are eligible for deduction is crucial to optimize your tax return.

Vehicle Qualifications for Section 179 Tax Deduction in 2023

Businesses to have several types of vehicle purchases that qualify for the Section 179 Deductions come 2023, including three categories: cars, pickup trucks, and SUVs.

- Heavy Vehicle: Vehicles used in business more than 50% of the time with a Gross Vehicle Weight Rating between 6,000 lbs. and 14,000 lbs.

- Small Vehicle: Vehicles used in business more than 50% of the time with a Gross Vehicle Weight Rating lower than 6,000 lbs.

In addition, the IRS also specifies specific rules about passenger capacity and other specifications to which vehicles must adhere to qualify:

- Specifically engineered to accommodate a minimum of ten passengers, excluding the driver’s seat.

- Equipped with a cargo space, which can be either open or covered with a cap, boasting an interior length of no less than 6 feet, and is not easily accessible from the seating area.

- Constructed with a unified enclosure that completely surrounds both the driver’s space and the cargo-holding apparatus, devoid of any seating located behind the driver’s area, and possesses no component of the body extending more than 30 inches beyond the foremost edge of the windshield.

Also, business owners understand these qualifications before committing to a purchase, so they know they can reap the most significant savings when tax season comes around.

Gross vehicle weight rating

Simply put, this determines whether or not a particular vehicle could be classed as “light duty” versus “heavy duty” – with light duty generally being exempt from limitations (as long as it meets other eligibility requirements).

Section 179 Cars

While there are some exceptions (specifically a passenger van, pickup, or panel truck designed for more than nine passengers), most cars are eligible for this deduction.

Small business owners can save on luxury models like BMWs and Cadillacs without worrying about depreciation over time.

SUVs

SUVs are another popular option for taking advantage of the Section 179 Deduction. Similar rules apply to other vehicles, though they must meet specific qualifications to be eligible for this tax deduction (specifically, an SUV must have a GVWR of 6,000 pounds or more).

However, larger model SUVs tend to exceed this limit, so those looking for the most significant savings may consider a smaller crossover or light-duty full-size model instead.

Other vehicles

Aside from cars and SUVs, other vehicles qualify under Section 179 Deductions, such as cargo vans and buses with seating no more than nine passengers.

As always, these eligible vehicles must meet all requirements specified by the IRS for business owners to take advantage of this business deduction.

That said if you’re in the market for one of these types of qualifying vehicles before committing to a purchase.

May Truck Models Qualify For Section 179 Deduction 2023?

Suppose you’re considering buying a truck for your tow truck enterprise. In that case, you might be wondering if any of the models exceeding 6,000 pounds in gross vehicle weight rating (GVWR) qualify for a Section 179 deduction in 2023. The good news is that some trucks listed below might be eligible for the deduction, which could help reduce your taxable income.

The List of Qualifying Truck Models For Section 179 Deduction

|

Truck Model and Year |

GVWR (lbs) |

| 2023 Ram 3500 | 10,700-11,400 |

| 2023 GMC Sierra 1500 | 6,700-7,200 |

| 2023 Chevrolet Silverado 1500 | 6,700-7,100 |

| 2022 Ford F250 | 10,000 |

| 2022 Ford F450 | 14,000 |

| 2022 Ford F650 | 20,500-29,000 |

| 2021 Kenworth T880 | 34,200 |

| 2020 Ford F550 | 19,500 |

| 2020 Ram 5500 | 19,500 |

| 2007 Peterbilt 378 | 50,000 |

| 2007 Peterbilt 379 | 48,000 |

| 2007 Chevrolet 3500 | 9,700-11,400 |

| 2004 International 4300 | 23,500 |

How Much Can I Receive For Each Eligible Vehicle in 2023?

The Section 179 deduction and bonus depreciation combination in 2022 allow businesses to claim up to $19,200 in deductions for vehicles weighing less than 6,000 pounds, $18,000 for the second year, $10,800 for the third year, and $6,460 for subsequent years.

For vehicles weighing more than 6,000 but less than 14,000 pounds, a maximum first-year deduction of up to $27,000 is allowed for 2022 ($28,900 in 2023), followed by regular depreciation schedules.

Additional Benefits: Special Bonus Depreciation

Business owners can take advantage of the special bonus depreciation rules after claiming section 179 deductions for vehicles to reduce their taxable income further. Businesses can unlock additional savings with special bonus depreciation – which ramps down to 80% in 2023.

This depreciation allows for a dollar-for-dollar deduction of new and used business equipment purchases, providing an additional benefit to the Section 179 Deduction.

Furthermore, the spending cap recently increased to $4,050,000 in 2023, allowing businesses to save even more money on large capital items with these tax deductions.

Wrap-Up

Working with the Section 179 Deduction Vehicle List 2023 is an excellent way for businesses to save substantial money regarding taxes. Understanding which types of vehicles qualify and how much you can claim in deductions allows business owners to maximize their savings each year.

With cars, SUVs, cargo vans, and other equipment all eligible for this tax credit, the potential savings are worth investigating. The Section 179 Deduction Vehicle List 2023 represents an excellent opportunity for businesses looking to make their purchases count when it comes time to pay taxes – so take advantage of these significant savings!

>>You may find interesting: